mayo 22, 2019

2644

Whether it's DRAM or NAND Flash, existing memory solutions face the physical limits of shrinking processes, which means that it will be more difficult to continuously improve performance and reduce costs.

In order to find new solutions with limited or no change to the existing platform architecture, next-generation memories such as Intel Optane have been widely discussed in recent years.

TrendForce's Semiconductor Research Center (DRAMeXchange) believes that next-generation memories and existing solutions have their own advantages and disadvantages, and the most critical opportunity is still price. TrendForce also said that memory vendors including Intel, Samsung and Micron have invested in next-generation memory solutions such as MRAM, PRAM and RRAM.

In the case of Intel, Optane is a server-based product based on 3DxPoint, as it has now introduced DIMMs that are fully compatible with server modules on the market. For the motherboard design factory, the same slot can be free to replace the server memory module or Optane solution based on the cost of the whole machine.

However, since the next-generation memory has not been scaled and standardized, the cost is high, so manufacturers are almost always locked in special applications such as data centers, especially the ultra-large-scale data center has a relatively high degree of customized design, which can target different memories. Plan for a new configuration.

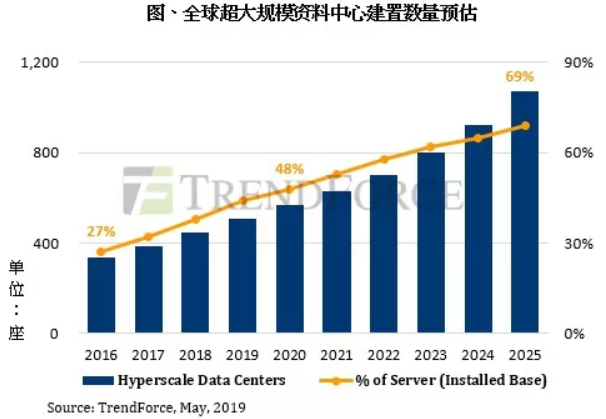

In recent years, due to the popularity of smart terminal devices and the maturity of artificial intelligence technology, most application services are integrated by servers, especially application services that rely on huge data for computing and training. In addition, with the development of virtualization platforms and cloud storage technologies, server demand is increasing day by day, and it also drives the growth of hyperscale datacenters.

According to the TrendForce survey, the number of global hyperscale data centers will be estimated to reach 1,070 in 2025 and 13.7% in 2016-2025.

Memory prices are expected to rebound in 2020

From the market point of view, DRAM and NAND are currently in an oversupply state, making the price of existing memory solutions still low.

In the case of DRAM, the continued decline in prices is basically affected by the decline in demand for servers and smartphones, resulting in rapid consumption and inventory climbs. NAND is due to the large number of competitors and is in a state of market competition. 2D NAND turns to different degrees of 3D

NAND caused a significant increase in supply levels. In summary, the price of DRAM and NAND in 2010 was rapidly falling at the same time, and the price of NAND is gradually approaching the cash cost of manufacturers.

Existing memory solutions are getting cheaper and cheaper, which is not the best entry point for next-generation memories, but looking ahead, the inventory replenishment momentum driven by demand recovery and price elasticity is expected to drive 2020 storage. Prices have rebounded, giving next-generation solutions a chance to enter the market. TrendForce believes that in the next few years, the market will gradually increase the consideration and use of next-generation memories in special areas, becoming another new option for existing solutions.