Publicado :13/8/2020 8:26:41

Haga clic en Contar:2103

1. Huawei has 5 options to respond to the US ban or sell HiSilicon to transfer IP.

According to CNBC reports, Neil Mawston, executive director of Strategy Analytics' wireless device strategy department, said that Huawei can cooperate with 15 chip suppliers around the world, but there are only five feasible options. They are one: transfer Kirin processor production orders to SMIC instead of TSMC; two: purchase chips from Unisoc; three: place an order to MediaTek; four: outsource chip foundry to Samsung Electronics; five: think The method allows Qualcomm to obtain immunity from the US ban.

However, Neil Mawston also said that each of the above options faces major challenges.

Among them, SMIC uses American equipment to manufacture chips, and is technologically behind TSMC. When the 7-nanometer process will be mass-produced is still an unknown; Spreadtrum is still unable to meet Huawei's needs in terms of current production capacity and quality; although Samsung It has its own Exynos series of chips, but Huawei is its strongest competitor in the field of smartphones, so cooperation may be difficult.

In addition, although there are reports from foreign media that Qualcomm is lobbying the U.S. government to lift the ban on its sales to Huawei, Neil Mawston pointed out that “the U.S. election will be held in November, and it’s hard to see a softening of the U.S. government’s tough stance this year.”

It seems that MediaTek is the most viable option for Huawei in the short term, but Mawston believes that the risk still exists because the company has some chips commissioned by TSMC and may still receive the attention of the United States.

In addition, Taiwanese media MoneyDJ pointed out that Neil Shah, Director of the Research Department of Counterpoint Research, believes that Huawei may consider selling HiSilicon and merging it with suppliers similar to MediaTek to transfer intellectual property rights to Huawei. The equipment builds an exclusive chipset and cooperates with its self-developed Hongmeng HarmonyOS operating system.

2. The U.S. election will affect Huawei's chip ban

The outcome of the US general election in November is likely to be a key factor in the survival of Huawei's smartphone division. If the Democratic presidential candidate and former Vice President Biden win, then policies on technology and China may change.

The Biden camp may be formulating its own policies around the geopolitics of technology, including chip technology. In order to win the support of American companies such as Qualcomm, it may propose to revoke Huawei's chip ban. Otherwise, the Trump camp may hope to win the support of American companies and may relax restrictions. "Abishur Prakash (Abishur Prakash) of the Center for the Future of Innovation (CIF), a consulting company headquartered in Toronto, Canada, specializing in geopolitics. Prakash added: "This may also be Huawei's strategy. Wait until November. And see what happens. "

Strategy Analytics' Mawston said that another potential solution after the election may be to allow Qualcomm to provide Huawei with ready-made chipsets, but may prohibit Chinese companies from designing their own chips as they do now.

Both Qualcomm and MediaTek produce chipsets that can be purchased "off the shelf", which means that multiple smartphone manufacturers may buy the same semiconductors from them. Huawei's current solution is customized because they designed their own Kirin chip. Nicole Peng, a mobile analyst at Canalys, said that if Huawei is forced to cooperate with general-purpose vendors, it will hurt its smartphone business. If they (Huawei) use standard solutions, it will be difficult to distinguish them from Oppo, Vivo and Xiaomi. They are expected to lose their competitive advantage, especially for Chinese companies in the high-end market.

3. Huawei will fully root the semiconductor industry chain

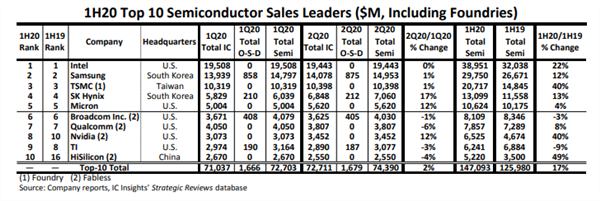

According to data from IC Insights, the revenue of TOP10 vendors in the first half of this year all exceeded US$5.2 billion, an average increase of 17% over the revenue of the top 10 in the first half of last year, and the increase was much higher than the average 5% level of the semiconductor industry. More than three times.

As the number one in the domestic semiconductor industry, Huawei HiSilicon has continued to expand its share in recent years with Kirin and other chips. In the list of the top ten global semiconductors for the first half of 2020 released by IC Insights recently, HiSilicon’s revenue rose 49% and entered the top ten.

Huawei HiSilicon has surpassed all the way in chip design, but unfortunately it ended up stuck in the chip manufacturing link. In order to solve this problem, Yu Chengdong said that in terms of semiconductors, Huawei will take root in all directions and break through the basic research and precision manufacturing of physics materials. In terms of terminal devices, such as display modules, camera modules, and 5G devices, Huawei is vigorously increasing its investment in materials and core technologies, realizing close linkage of new materials + new processes, and breaking through bottlenecks that restrict innovation.

Yu Chengdong said: "Now we have entered the era of third-generation semiconductors from the second-generation semiconductors, hoping to lead in a new era. Huawei is investing in multiple devices in the terminal. Huawei has also driven a number of Chinese companies Growth, including radio frequency, etc. to leap to high-end manufacturing."

However, the semiconductor industry chain is very long, and one or two companies cannot do it all. Yu Chengdong called on partners in the semiconductor industry chain to take root in all directions, starting from technology to create a new ecosystem.

In terms of "root technology", Huawei recommends that the industry pay attention to the EDA and IP fields, key algorithms and design capabilities. There are also production equipment and materials fields including 12-inch wafers, photomasks, EUV light sources, immersive systems, lenses, etc. In the design and manufacturing process, attention is paid to IC design capabilities, IC manufacturing and IC packaging and testing capabilities. IDM covers the design and manufacturing process integration of radio frequency, power, analog, storage, sensor and other devices.

In addition to chip manufacturing restrictions, Huawei is also restricted in software systems and cannot use Google's GMS service. In response, Huawei launched the Hongmeng operating system and HMS (Huawei Mobile Service) mobile services last year.

It is understood that the HMS ecosystem is currently achieving rapid growth globally. Huawei's terminal global monthly active users have reached 700 million, Huawei's global registered developers have reached 1.6 million, and the number of applications that access HMS Core globally exceeds 81,000.

Yu Chengdong also said: "In terms of HMS, the US chip and mobile phone mobile services were not used by Huawei last year. Huawei can only solve chip and ecological problems by itself, develop HMS, and strive to break through the US blockade. Now every month, week, and day, The ecological experience is improving."

As for Hongmeng OS, Yu Chengdong said that Huawei's previous smart screen products have begun to carry. In addition, Yu Chengdong also revealed that this year Huawei's smart watch products will also be equipped with Hongmeng OS. In the future, all of Huawei's IoT products, including PCs, tablets, and even mobile phones, may use Hongmeng OS.

Currently Hongmeng is open source, and Huawei also proposes to build an independent OS ecosystem. Yu Chengdong said, "Hongmeng OS will become a worldwide operating system in the future."

Under the strict crackdown by the United States, in the short term, Huawei may have to rely on non-US technologies to achieve chip supply. Although China's semiconductor industry has experienced ultra-fast development, there are still many shortcomings. In the long run, China still needs to vigorously develop its own semiconductor industry.